Guide as numerous no cost consultations as you will need. Advisor matches shared by Zoe are meticulously curated.

Morgan Stanley is differentiated with the caliber of our numerous workforce. Our society of accessibility and inclusion has designed our legacy and styles our upcoming, helping to bolster our company and produce value to customers.

In this particular Distinctive report, we respond to many of the vital thoughts investors have about what portfolio diversification is, how to accomplish it, and why proficiently diversifying an investment portfolio could possibly be obtaining harder to do while in the facial area of increasing interest fees and inflation.

Investments are just a single facet of wealth planning. Your tax charge impacts your investment returns. Your borrowing impacts your insurance policies needs. Your income stream impacts your Life style.

Since our founding in 1935, Morgan Stanley has continuously sent initial-course business enterprise in a first-class way. Underpinning all that we do are five Main values.

With the opportunity for tax-free of charge growth and tax-no cost withdrawals in retirement,2 a Roth IRA can help you keep extra of That which you generate.

Failure of a corporation to qualify as being a REIT under federal tax regulation could possibly have adverse penalties with a customer account. In addition, REITs have their own expenses, and a customer account will bear a proportionate share of Individuals costs.

Your Wealth Advisor will perform with you to be aware of your circumstance and Create a comprehensive wealth method that aligns with your targets these days, tomorrow, and into the long run.

Folks will argue that investing in what you know will depart the standard investor too greatly retail-oriented, but knowing a firm, or employing its products and services, is usually a balanced and wholesome method of official statement this sector.

The other issue to remember about your time horizon is the fact that it's constantly shifting. So, to illustrate your retirement is currently 10 years absent as an alternative to twenty five years—you may want to reallocate your assets that will weblink help decrease your publicity to larger-risk investments in favor of more conservative ones, like bond or revenue market funds.

Under a SIMPLE IRA, staff members are immediately vested, meaning they have total ownership of every one of the funds inside their accounts. Contributions made by your organization could be deducted from its taxes.

Their target is that will help individuals and families navigate life's major choices with the assistance in their financial experts.

Minimize your taxable income by deducting your contributions, if eligible, and your potential earnings could grow tax deferred3.

Commodity-focused funds Whilst only by far the most knowledgeable traders really should put money into commodities, incorporating fairness funds that focus on commodity-intensive industries in your portfolio—including oil and gasoline, mining, and all-natural sources—can offer a very good hedge against inflation.

Luke Perry Then & Now!

Luke Perry Then & Now! Jenna Jameson Then & Now!

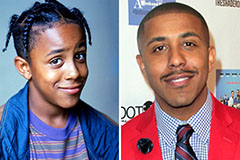

Jenna Jameson Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!